Forex Essential Terms for Beginners: Your Ultimate Guide to Start Trading

Introduction

The world of Forex trading can be thrilling and intimidating. IIf you have a good grasp of the basics, you will be able to confidently begin your trading journey. This article will guide you to the fundamental Forex terminology that every novice needs to understand, ensuring that you know "Okay, I learned it, and I can start trading."

Why These Terms Matter

The ability to understand these terms is vital in making well-informed trading choices as well as managing risk and maximising profit. We'll look at the most important phrases that all Forex trader should be aware of.

Key Forex Terms Every Beginner Must Know

1. Currency Pair: The Backbone of Forex Trading

Definition: In Forex trading, currencies are always traded in pairs. The first currency in a pair is called the base currency, and the second is the quote currency. In the EUR/USD pairing, EUR represents the currency of base. USD is the quoted currency. The exchange rate is a measure of how much quote currency is required to purchase one unit of base currency.

Use case: In the event that you wish to trade euro with USD, or the US dollar, you'll examine the currency pair EUR/USD. In the case of, say, if you are convinced it is likely that there is a chance that European Central Bank will boost rates of interest, you may think that EUR will increase in value against USD and you decide to purchase the EUR/USD currency pair.

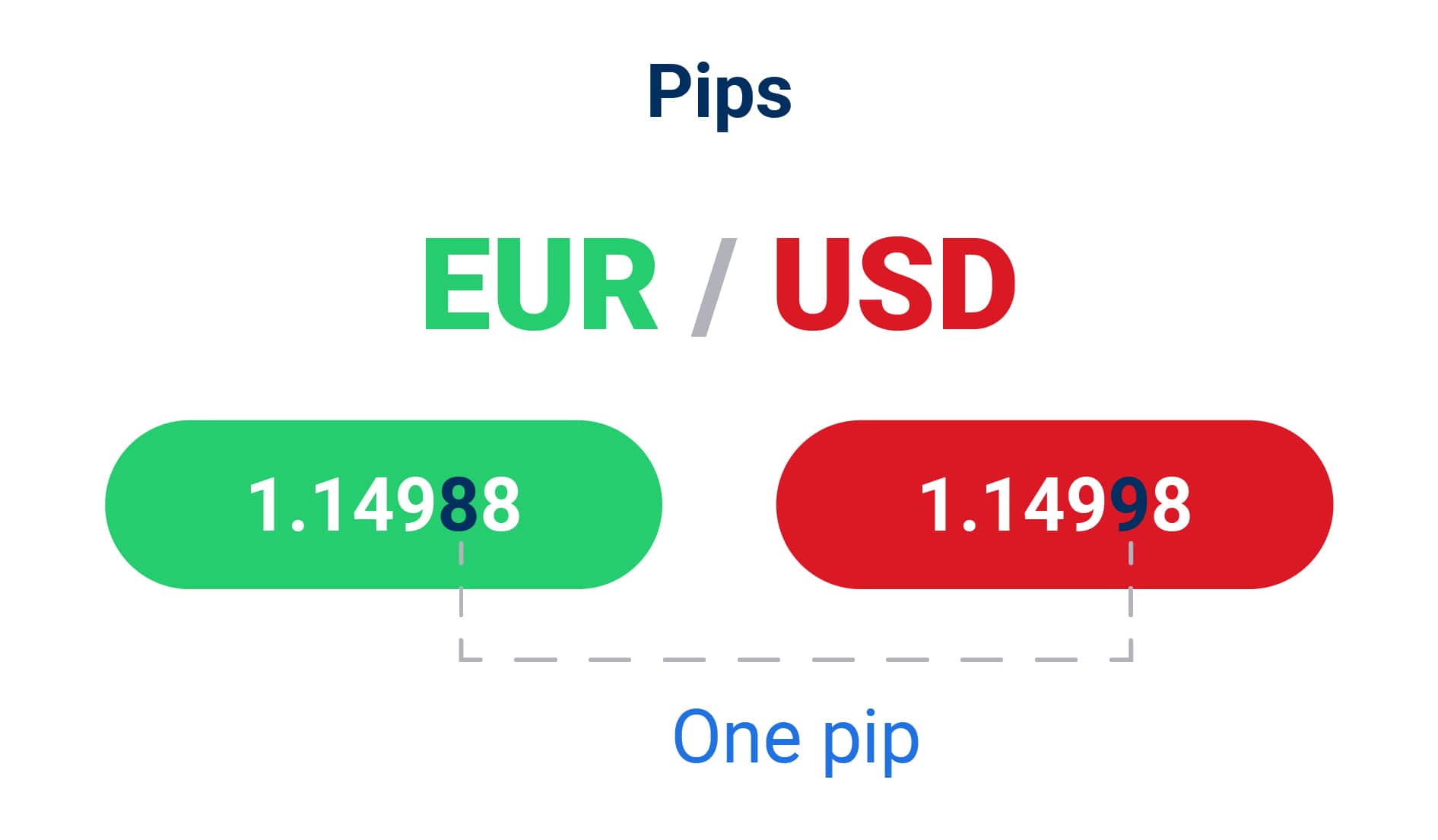

2. Pip (Percentage in Point): Measuring Movements in Forex

Definition: The term "pip" refers to the smallest movement of price on the Forex market. It is typically only one digit at the 4th decimal point of an exchange rate (0.0001). If, for instance, the EUR/USD changes between 1.1050 to 1.1051 the pair has gone up 1 pip.

Use case: When you calculate your possible profits or losses from trading, you'll employ pip. In the example above that if you start the trade at 1.1050 and close it at 1.1070 and you've gained 20 pip. Knowing pips can benefit you assess the effect of price fluctuations in your trading account.

3. Spread: The Cost of Trading Forex

Definition: The term "spread" refers to the gap of the bid value (the cost that you are able to trade an exchange) as well as the asking price (the cost that you are able to purchase the currency). This is basically the price of trading.

Use Case: When entering the market, you should be aware of the spread, especially in volatile markets. The spread could eat off your profit. In particular, in the event of significant economic news announcements spreads could widen considerably which makes it more expensive to trade or leave.

Pro-tip: Make sure you examine the spread before putting in the trade, particularly when there is a high level of volatility. A tight spread is preferred as it lowers the cost of trading.

4. Leverage: Amplify Your Trading Power

Definition: Leverage allows traders to take control of a greater market with a lesser amount of cash. In the example of 100:1 leverage you can take control of a $100,000-sized position using the sum of $1000.

Use Case: If you have a small amount of capital and want to benefit from larger market fluctuations, you can use leverage to increase your trading power. Be cautious with excessive leverage as it can improve the possibility of losing money. As an example, one percentage move against your investment that leverages 100:1 can erase your entire capital.

Common Mistake: Beginning users often make the mistake of using leverage and suffer huge loss. Make sure you use leverage in a responsible manner and warrant that you are aware of the dangers.

5. Margin: The Security Deposit for Your Trades

Definition: Margin refers to the amount needed to maintain and open the leveraged position in trading. It functions as a deposit security to protect against loss.

Use case: When you open the first trading account You must assure that you have enough margin on your account. If your equity in the account is lower than the margin required and you are unable to meet the minimum margin, you could get a call from the margin to transfer more funds or to close the position. In the case of example, if you trade together a 50:1 leverage, you must keep 2percent of your total amount of trades in your account for margin.

6. Lot Size: Understanding Trade Volume

Definition: The word "lot" refers to an established unit of measurement to measure the size of trade within the Forex market. A standard size for a lot comprises 100,000 units base currency. Additionally, there are mini heaps (10,000 units) as well as Micro lots (1,000 units).

Use case: In determining the amount of trade, you'll select an amount of lots according to your risk management plan. If you are a beginner, beginning using micro lots may benefit to manage risks and acquire confidence without huge capital exposure. In the example above, trading a tiny lot in EUR/USD can expose the trader to a pip around $0.10.

Example: A trader with a small account might start with micro lots to minimize risk while gaining experience.

7. The Long and Short Positions Profit from any market direction

Definition:

- Long Position: Buying a currency pair in the hope that its value will increase.

- Short Position: Selling a currency pair in the belief that its value will decrease.

Use Example: If you think that the euro will rise against the dollar, then you might consider taking a long position in EUR/USD. In contrast, if you believe that the euro is going to weaken and weaken against the dollar, you should opt for a short investment. In the case of tensions in the Eurozone grows, you could be short EUR/USD, anticipating a decline in the value of the euro.

8. Stop-Loss Order: Protect Your Investment

Definition: A stop-loss request is a price that has been predetermined where a trade is instantly close in order to limit losses.

Application: To secure your investment, place a stop-loss limit lower than your entry price if you are you are going long or over your entry price when you go short. This reduces risks by cutting down on possible losses. As an example, if invest in EUR/USD at 1.1050 You could create a stop loss at 1.1020 so that you can limit your loss at 30 pip.

Example: A stop-loss is a way to prevent a loss from growing into a larger one. If the market goes towards you, the trading will be closed immediately, thus protecting your accounts from major loss.

9. Take-Profit Order: Secure Your Gains

Definition: Take-profit orders is a price that has been predetermined where a trade will instantly close in order to protect the profits.

Utilization Case: When you create an order for take-profit that you can set your preferred profits. As an example, if make a trade for 1.1050 and you set a profit of 1.1070 then your transaction will be closed automatically once your price hits 1.1070 and you will be able to secure your gain of 20 pip.

Example: by setting up a take-profit purchase order to assure that you make money and not have to keep an eye on the market continuously. This can be particularly beneficial for traders who are unable to monitor the market throughout the day.

10. Bid and Ask Price: Knowing the Market's Offer

Definition:

- Bid Price: Is the price that your broker will buy the currency pair.

- Ask Price: The price at which your broker will sell the currency pair.

Application: When you make an order, you'll notice the bid and offer prices. The gap between the two price points (the spread) is one of the most important factors to think about as it impacts the entry and exit areas. In the example above, EUR/USD is trading at a bid of 1.1050 with an ask price of 1.1052 and the spread is two pips.

11. Broker: Your Trading Partner

Definition: A broker is a person or company who helps in the selling and buying of currency. The brokers serve trading platforms and offer diverse types of accounts and can be charged commissions, spreads, or charges for their services.

Use case: Making sure you choose a reliable broker is crucial to ensure an easy trading experience. Choose a broker with minimal spreads, a good customer support and a reliable trade platform. If, for instance, you're new to trading, you may choose a company that has education resources as well as a simple interface.

You can find your broker from here.

12. Technical Analysis: Predicting Price Movements

Definition: The term "technical analysis" refers to analysing currency pairs using past price fluctuations as well as trading volume. Traders make use of charts, patterns as well as technical indicators to forecast future price fluctuations.

Use Example: before you place an order, it is possible to look at charts for patterns, trends, and support levels. You can also use indicators such as moving averages or RSI to benefit you make educated decisions. If, for instance, EUR/USD displays a bullish pattern on the chart, then you could decide to buy.

13. Fundamental Analysis: Evaluating Economic Factors

Definition: fundamental analysis is the evaluation of currency pairs on economic indicators, geopolitical developments as well as other variables that impact the entire economy. Traders analyze information like GDP, interest rates, and figures on employment in order to make educated trading choices.

Use Example: If you wish to know how news about economic conditions influences the prices of currencies it is essential to conduct basic analysis. In the case of, for instance, when you hear that the US Federal Reserve announces a rate increase, you could think that the USD to increase in strength and choose to buy USD-based currencies accordingly.

14. Liquidity: Ensuring Smooth Trade Execution

Definition Liquidity is the ease in that an asset is either sold or bought on the market, without impacting its value. This Forex market is famous as having a high level of liquidity which means that there are always buyers and sellers.

Application high liquidity guarantees your trades are completed promptly and at the ideal price. This is particularly important in times of major events, when fluctuations are high. As an example, trading the most popular pairings like USD/USD or EUR/USD generally ensures greater liquidity and quicker execution of orders.

Examples The trader may prefer EUR/USD trading over more liquid currencies like NZD/CHF in order to gain lower spreads, and quicker trade execution.

15. Risk Management: Protecting Your Capital

Definition: Effective managing risk is essential for the long-term viability of Forex trading. It involves setting stop-loss and take-profit limits as well as diversifying your portfolios and never putting more than a fraction of your capital invested in trading on one trade.

Use Case: To protect your trading capital, you implement risk management strategies. As an example, you could opt to never put greater than 2% of your funds on just one trade. This will warrant that not a one loss will significantly impact the balance on your account. This strategy helps you keep your portfolio healthy and lessens tension that comes with trading.

Common Fail: Many beginners fail to pay attention to their risk management and can result in substantial loss. Set stop-loss orders as often as you can and adhere to guidelines for managing risk.

Conclusion

Knowing these important Forex terminology is the initial step to becoming an effective trader. When you're familiar with the terminology of Forex and understanding the terminology, you'll be better able to navigate the marketplace and make more informed trade decisions. Keep in mind that constant learning and practice is the key for learning to master Forex trading.

Ready to Start Trading?

Once you've grasped the basics of terminology and the concepts behind it now you're all set to embark on your Forex trading experience. Start a demo account with an established broker so that you can test the concepts you've studied without having to risk actual money. When you obtain knowledge and experience then you'll be able to move on into a live account and begin trading in real time.

Follow our site for ongoing tips, updates, and advanced trading strategies.

Happy trading, and may your Forex journey be profitable and rewarding!